How I Invested in a $2 Billion Company

Founders care about your story just as much as you care about theirs

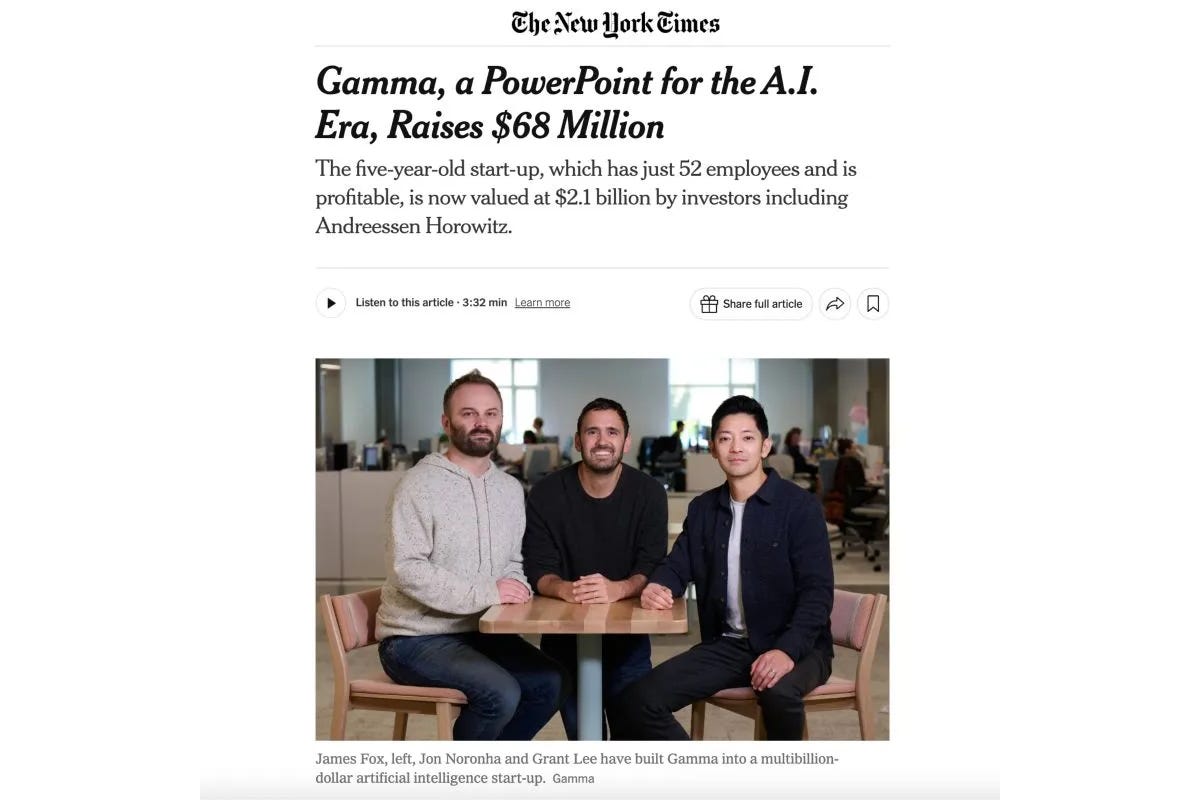

Last month, Gamma announced that it had raised $68 million from Andreessen Horowitz at a $2.1 billion valuation.

In 2023, I was fortunate enough to meet Gamma CEO Grant Lee through my network and he had been following my work. Hyphen Capital ended up investing in their seed round and I obviously couldn’t be more thrilled for our LPs and for the Gamma team.

This is only the beginning for the company. Raising a round means nothing, it is just another mark on the road to liquidity. Grant and his hard working team of 52 employees and growing are generating over $100 million in annual revenue with over 70 million users. They efficiently accomplished all of this after raising only $22 million through their Series A and have been profitable for a while now.

Grant is a special founder, because he builds authentically and transparently. He regularly shares his personal learnings on LinkedIn, where his audience of 80,000 followers are. Many of whom are the target audience of Gamma and highly likely to create presentations. Grant creates value by providing insights on product, marketing, sales, fundraising and countless other business topics. These are also topics that people need to generate presentations about all the time.

Getting to Yes

I didn’t know Grant before I invested in Gamma. A trusted mutual friend who was his first investor, knew that I was supporting Asian American founders, so he introduced us when Grant was raising a seed round led by Accel. They were classmates at Stanford together and have known each other for years.

Lesson #1: Your network is your access.

If you can meet a founder through a trusted referral who speaks highly of your character and integrity, you will increase your probability of investing infinitely. Friends and existing investors are strong filters for other new investors joining the inner circle. The broader your network, the more likely you are to have a connection with a founder you want to reach. But having a wide and shallow net doesn’t mean you will catch anything. The quality and depth of that net makes a big difference.

Lesson #2: Founders want to work with people they know and trust.

Founders don’t want a wildcard in the mix, because starting a company is hard enough without having additional unnecessary drama or unpredictability on the cap table. A founder is more likely to trust you through a very warm referral than a cold outreach or lukewarm introduction. If you don’t have a warm referral and manage to connect with the founder via cold outreach, build trust in that first meeting. That means demonstrating that you will add value with your insights and questions, providing strong references from other respected founders, and simply finding commonality with each other. Sell yourself and your expertise or how you can open doors for them.

Lesson #3: Your reputation precedes you.

People often form an opinion about you before they even meet you. They do Google or LinkedIn searches and do their research. They will also backchannel you through their network to make sure there aren’t skeletons hiding in any closets. Ideally you’ve invested in companies they know of or better yet, know the founders of. Your reputation is what people say about you when you’re not in the room, and founders talk to each other and other investors.

Luckily for me, Grant had been following my advocacy work and investment in the Asian American community well before meeting me. He resonated with the Hyphen Capital mission and we clicked immediately. He saw value in my network and it helped that I was also a fellow startup founder.

Investing with a Mission

When I started Hyphen Capital, my mission was to change the false narrative that Asian Americans are not good leaders. I wanted to shatter the bamboo ceiling with story after story of successful founders who proved the naysayers wrong. I pulled together a community of investors from founders to executives to law partners to surgeons and even an NBA assistant coach, to support these founders. Our powerful network includes the founders of Old Navy, YouTube, MyFitnessPal, Gusto, Credit Karma, StitchFix, Peloton, Honey, Webflow, Patreon, Rotten Tomatoes and more. It includes the CEOs of Calm and OpenTable, CFOs of Visa, LinkedIn, Masterclass and so many others.

Together, we’ve invested in several successful companies: Safebase was acquired by Drata for $250 million. Pry Financials sold to Brex for $90 million. Revela sold to Oddity for $76 million. Formation Bio raised at a $1.7 billion valuation. Persona raised at a $2 billion valuation. In total, we’ve invested over $30 million in 100+ companies founded by Asian Americans, half of whom have female founders. Here are just a few of my favorite consumer investment stories:

The Gaming Console

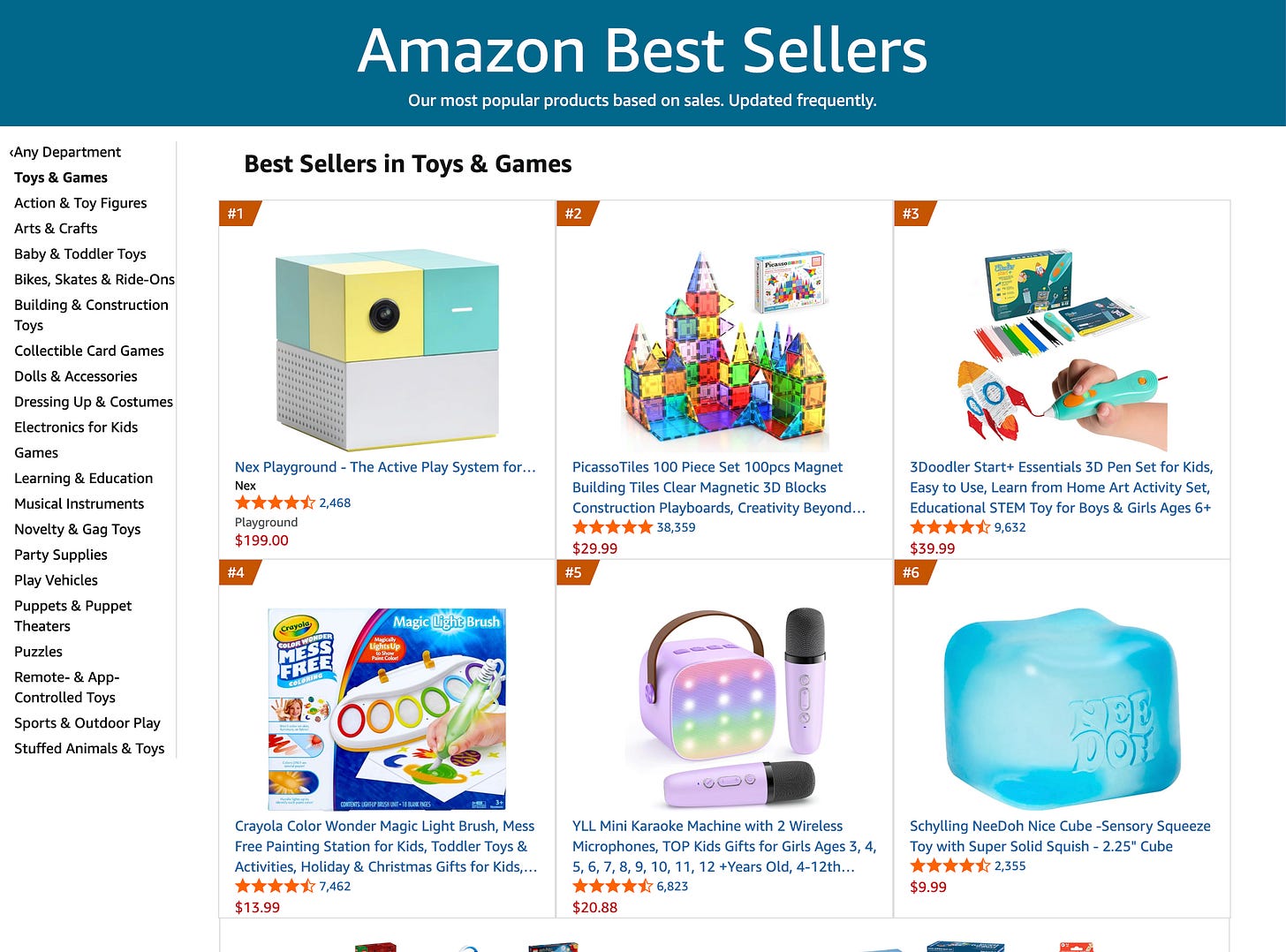

An iPhone app propped up on a chair turned into the #1 selling product in Toys & Games on Amazon.

Four years ago, I invested in three co-founders from Hong Kong named David Lee, Tony Sung and Reggie Chan. My friend Alex Wu was part of my founder community Asian American Founders Circle and he ran partnerships and business development for them. Their company Nex was building a basketball AR skills app called Homecourt, which my nephews and their friends used and loved. My son tried it and he was also hooked. We found ourselves propping up my phone on a chair while he dribbled and watched the screen light up with points and sparks. It made practicing more fun.

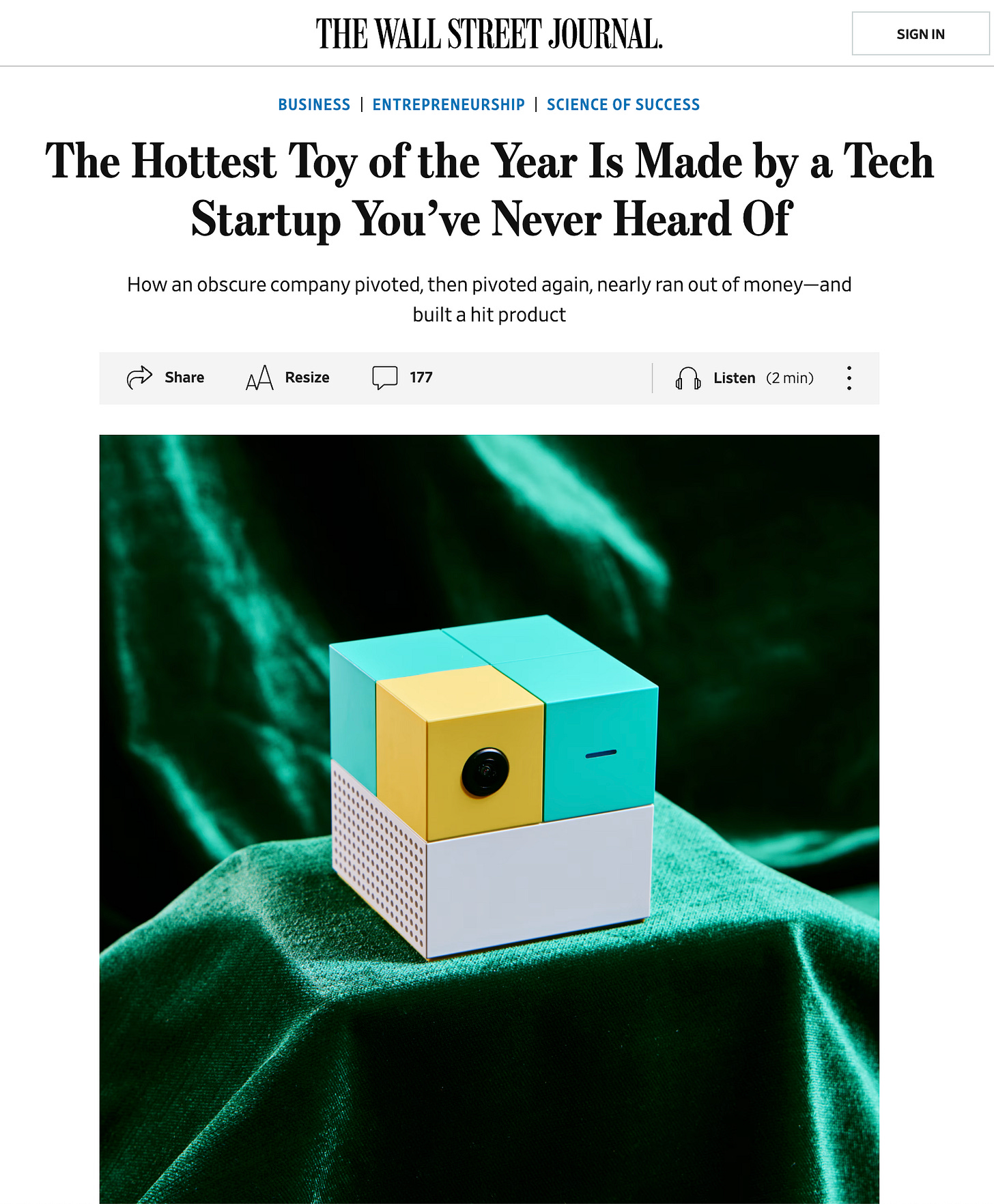

They created another mobile app called Active Arcade and added new fun augmented reality games. Eventually they saw an opportunity to build a new gaming platform device that they would call Playground. It was a huge risk to bet the company on a hardware device, when software margins were so much better. But the team had conviction and rolled the dice, and it has paid off big time.

Now this little engine that could is sitting right next the Nintendo Switch, Sony Playstation and Microsoft XBox at Target, Walmart and Best Buy. Playground now has titles and partnerships with the NHL, Barbie, Bluey, How to Train Your Dragon, Kung Fu Panda, Care Bears, Sesame Street, Gabby’s Dollhouse, Teenage Mutant Ninja Turtles and more. The Wall Street Journal called it the “Hottest Toy of the Year.” It’s gotten rave reviews from The New York Times, USA Today, Parents Magazine, and Polygon.

It quickly became the top selling product in Amazon’s Toys & Games category, and will sell over half a million units this holiday season. Our family loves our Playground and we’ve played with it every week since we’ve gotten it, because instead of the kids staring at a screen, the games are up and moving with the interactive games.

All from a team that started with a basketball app, who believed in their tech and had the conviction and confidence to bet on themselves. They refused to play small and be put in a box. Instead they will be selling millions of little cubes into households around the world. They are practically sold out everywhere, but hopefully you can get your hands on one before Christmas!

The Soup Dumpling

Restaurant quality frozen soup dumplings steamed to perfection in 11 minutes.

I was first introduced to Caleb Wang via the founder of Italic, Jeremy Cai. Caleb and his wife Jennifer Liao had been following my AAPI advocacy work during the pandemic as well. Caleb and Jennifer are the founders of MìLà, a Chinese frozen food company that started with soup dumplings as their first product. They sent me some samples and I was hooked. As an avid regular of Din Tai Fung restaurants in Taiwan, the fact that I could have xiao long baos at home, any time, in 11 minutes, seemed like black magic to me.

I was shocked to learn that most if not all of the major frozen Chinese food brands in America are actually owned by non-Chinese companies like Ajinomoto who owns Ling Ling dumplings, CJ Foods who owns Annie Chun’s, and Conagra who owns PF Chang’s frozen foods. There’s an estimated 40,000 Chinese restaurants in America and Martin Yan has filmed over 3,500 episodes of Yan Can Cook for PBS, and yet none of the major frozen food brands here are owned by Chinese Americans.

Caleb and Jennifer wanted to create an authentic brand of Chinese cuisine, by Chinese American entrepreneurs. I wanted to support their dream, while also helping to spread quality Chinese food to parts of the country that do not have access to it. This was an investment in not just a company, but a mission.

When we invested, they were a predominantly direct-to-consumer business with some distribution in specialty retailers. Now they can be found at Targets, Walmarts, Whole Foods, Krogers and Costcos nationwide in over 7,000 retail locations. They’ve even partnered with Marvel Superhero Simu Liu as their Chief Content Officer to promote their products. MìLà will continue expanding their products from dumplings and noodles in the future.

The Sparkling Water

La Croix but with Asian-inspired flavors.

I had first heard about Sanzo sparkling water with real Asian fruit flavors like calamansi, lychee, yuzu and mango through my good friend Andrew Chau, co-founder of Boba Guys. He connected me with Sanzo founder Sandro Roco and I loved his vision for bringing Asian-inspired sparkling water to mainstream grocery aisles. Most people had never heard of calamansi before, a citrus fruit native to the Philippines, but Sandro was changing that.

Sandro understands the importance and power of representation which is why he wanted to bring these drinks to shelves of grocery stores around the country. He even partnered with Disney to put Turning Red, Raya and the Last Dragon and Shang-Chi on Sanzo cans when they premiered. We also worked together to do a limited edition Asian Pear flavor with Jeremy Lin on the cans for when 38 at the Garden premiered on HBO Max.

These cans are sitting on my desk right now as I type this:

Sanzo can now be found in Whole Foods, Panda Express, Sprouts, Target and other retailers all across the country. Sandro is introducing people from South Carolina to Indiana and from New Mexico to Ohio, to new Asian flavors that they have never experienced before.

One of their newest investors is model and mega-influencer Chrissy Teigen who currently has over 40 million followers on Instagram.

The Petite Clothier

Stitch Fix for petite women

5’1” CEO of Short Story, Isabella Sun, cold e-mailed me after hearing my name several times talking to other Y Combinator founders and reading my post about building your own house. I also happened to work at Yahoo with one of her investors and advisors, Tim Brady. Isabella founded Short Story because as a petite Asian American woman, she was frustrated with the limited clothing options for her build. She wanted to solve the fit problem for herself, and the 33 million other petite women in America.

Since we invested, Short Story has gone from selling $1 million in petite clothing to tens of millions of dollars of inventory, including private labeled pieces. They have cornered the market in petite women’s fashion by meeting the demand of a large niche of customers.

Short Story has been the USA Today Reader’s Choice #1 Clothing Subscription Box for five years in a row. They have glowing reviews from Business Insider, Refinery 29 and Buzzfeed.

Asian women are the least likely demographic to be promoted in Corporate America, because the narrative is that they “lack leadership potential” or “have no presence”. Meanwhile, women like Isabella, Vicky Tsai, Ju Rhyu and countless others are successfully building massive businesses and debunking the false narrative with their highly effective leadership.

I have story after story of investing in underdog founders like David and the Nex team, Caleb and Jennifer, Sandro and Isabella. Over the years, I have invested time in building a community and network of seasoned founders and executives who can add tremendous value to every single company we’ve invested in. I have also curated extensive relationships with investors who can help support the growth of these companies.

Investing in early stage companies is not a numbers business, it’s a people business. You can identify all of the best founders in the world with your models, but if you can’t get on their cap table, it doesn’t matter. The founders have to choose to take money from you. Your reputation, your network and your insights are all critical in differentiating yourself from anyone else who can write a check.

I’ve poured my heart and soul into making Hyphen Capital stand for something. An investment from us is more than access to capital; it’s access to a pool of domain expertise, potential customers and partners, a community of fellow founders and future investors. Ultimately, these all are part of the story you tell to convince founders to take your money. You are responsible for crafting the story you want to tell as an investor to set yourself apart.

What is your story?